Case Study

Case Study Our

Business Valuations Online

Explore our case studies to see how BVO helps clients achieve their financial goals with tailored solutions and expert guidance.

Success Stories: Real-World Examples of BVO's Impact

Explore our case studies to see how BVO helps clients achieve their financial goals with tailored solutions and expert guidance. Discover how we support individuals and businesses in securing a brighter financial future.

Success Stories: Real-World Examples of BVO's Impact

Background

Many of us are taught not to make judgements on face value alone. And in the case of business valuations, this common life lesson certainly applies.

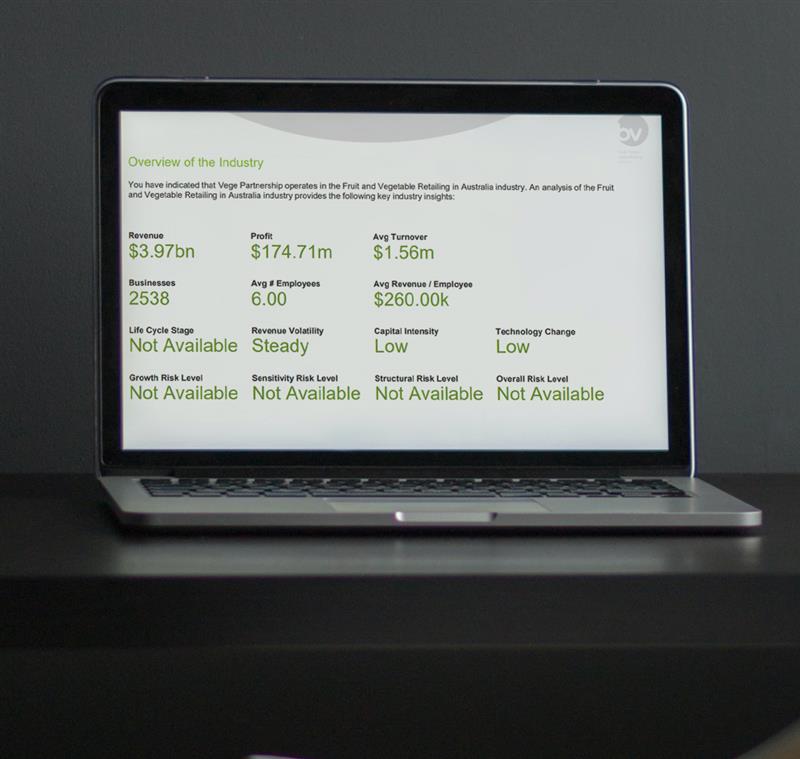

Business Valuations Online was contacted by a family fruit and vegetable shop being run as a partnership of various companies, trusts and individuals. On the advice of their accountant, the fruit and vegetable shop was seeking to reorganise the business into a corporate structure. This restructure would allow various discretionary trusts to hold different parcels of shares while also taking the future into account for succession purposes.

Although it may sound like overkill for a humble fruit and vegetable shop, the turnover of this this retail and wholesale operation was well in excess of $10 million per annum which warranted the restructure plan.

Key Outcomes

- Business Valuations Online worked through the complexities of the business to provide the accountant and multiple parties involved with a detailed valuation which paved the way for the restructure.

- Our comprehensive valuation provided all required information to meet Capital Gains Tax and Stamp Duty compliance obligations.

Background

Business Valuations Online was approached by an accountant, whose client - a structural and civil engineering firm - was preparing for the entry of new shareholders from within the ranks of the entity itself. Our services are often enlisted by accountants in these situations when their clients’ businesses are experiencing periods of growth, change and expansion.

The accountant required a valuation of the structural and civil engineering firm business and entity so as to allow senior employees to purchase tranches (portions) of shares from existing owners over a number of years.

Key Outcomes

- Business Valuations Online worked through the complexities of the business to provide the accountant and multiple parties involved with a detailed valuation which paved the way for the restructure.

- Our comprehensive valuation provided all required information to meet Capital Gains Tax and Stamp Duty compliance obligations.

Background

The services of Business Valuations Online are often called upon to assist during challenging periods such as a business entering voluntary administration. A kitchen joinery company had entered into voluntary administration prior to having sold its trading business to a related party. The transaction was only discovered upon the administrator being appointed and subsequently, the administrator required a valuation of the trading business to determine whether the consideration paid by the buyer was in fact commercial, or not.

Key Outcomes

- Business Valuations Online performed an independent valuation of the business correct at the date of the transfer taking place.

- The administrator for the company was satisfied with our valuation and utilised it in his investigation of the transaction.

Background

Succession planning in any business can become a complicated affair, and our independent valuation services are often called upon during these times. An accounting firm referred their client to us; a group made up of four companies. The client required a valuation of a holding company and three subsidiaries for succession planning purposes.

The three subsidiaries a piggery, a stockfeed production and wholesale business, and a livestock transport business. The client’s elderly father owned all the shares (personally) in the holding company that held 50% of the shares of the three trading companies.

Key Outcomes

- Business Valuations Online performed valuations of the three trading entities as well as the holding company which allowed the referring accountant to assess Capital Gains Tax implications, Stamp Duty, and other issues.

- Based on the findings of our valuations, the holding company was transferred into a discretionary trust, thereby structuring a succession plan allowing the businesses to continue trading without interruption in the event of the Director of the holding company being incapacitated.

Background

Business Valuations Online was contacted to provide a valuation of a restaurant in Thredbo, NSW.

During our introductory dealings, we learned of the major pain point within their operation; a rather unusual business management agreement in place. This agreement stipulated a fee payment to the Managing Agent. However, rather than a set amount, this fee was to be calculated in relation to the increase in value of the restaurant between the date the agreement was entered into and the date it ended.

Key Outcomes

- Our examination found the valuation method set out in the restaurant’s business management agreement did not adhere to any universal or accepted valuation principles. Therefore, the business management agreement was not commercially acceptable, in any sense.

- The authentic valuation produced by Business Valuations Online allowed this matter to be settled fairly. All parties walked away with a satisfactory outcome by relying on the accurate, robust and independent valuation we delivered.